Startup Investor Platform. In the context of this blog, we are approaching this from a Startup’s perspective, i.e., a platform that can be used by a Startup that needs to raise capital.

Introduction:

As a startup founder seeking to fuel your business venture, one of the most daunting tasks you face is raising capital. In today’s digital age, the plethora of online platforms connecting startups with potential investors can be overwhelming.

Making the right choice will significantly impact the success of your fundraising efforts. Welcome to this blog, where we explore and compare 13 such platforms to help you avoid overpaying and find the best fit for your startup. Throughout this discussion, we will analyze their pros and cons, pricing, and user ratings to provide you with valuable insights into making an informed decision.

Is Every Startup Investor Platform The Same?

The short answer is NO. They mostly fall into one of the following categories:

Database

How Do Equity Crowdfunding Platforms Differ?

1. Investor Type – are the platforms open to all investors (aka retail), or only to accredited investors? Platforms can be open to all investors if the new regulations that allow that (e.g. JOBS Act) are there. Some countries enabled that already, but most have not. Platforms open to accredited investors do not require new regulations.

2. The role of the platform itself (or the body managing it) – plays a role in the deal itself. There are platforms that are basically just facilitating the interaction between angels and Startup companies, without taking any active role in the deal itself. There are platforms in which a lead investor manages the deal and invites others to join in. And there are platforms in which the fund itself (the platform), manages the deal, negotiates, invests in the company, and invites the investors to join.

Startup Investor Platform: Who Made Our List?

1. Ourcrowd

2. Fundersclub

3. SeedInvest

4. StartEngine

5. Wefunder

6. Republic

7. Netcapital

8. AngelList

9. InvestorHunt

10. OpenVC

11. Foundersuite

12. Crunchbase

13. Pitchbook

Selection Criteria: These are all entities that either I have used, or startups I’ve invested in or mentored have used. That was the only criterion for landing on this list.

Startup Investor Platform – 2022 Equity Crowdfunding Pros and Cons List

| Platform | Pros | Cons | Rank |

| Ourcrowd | Global | 10 years old | Platform decides who they invest in | 225K investors | $2.2Bn in committed capital | Funded 427 Startups | Reviewed 18K Startups | 2.3% chance of getting funded [better than normal] | Investment size averaged $250K | Investment round size that they participated in ranged from $2M – $20M | If accepted, the process takes ca. 6-7 months until funds flow | 1 |

| Fundersclub | Platform decides who they invest in | 35K investors | $182M in committed capital | Funded 360 Startups | Investment size averaged $250K | Investment round size that they participated in averaged $5M | Investment size ranged from $50K – $250K | US-Centric | 2 |

| Seedinvest | Being taken over by STARTENGINE | At the time of writing their website is down. For 2 days. Possibly related to the acquisition by Startengine | 8 | |

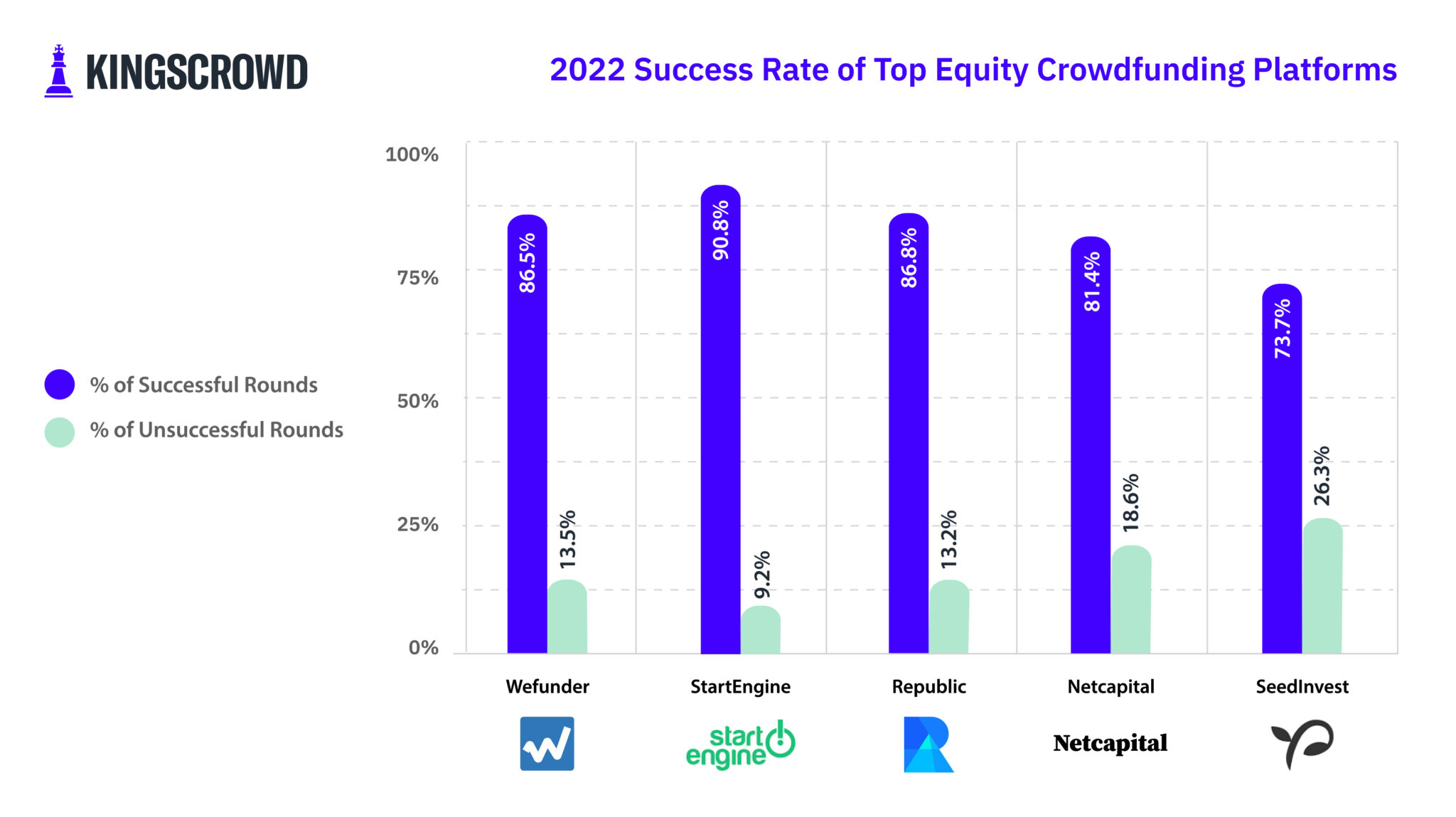

| Startengine | $1.1Bn raised for startups over 750 rounds | 1.7M committed investors | 90% of offerings reach their minimum funding goal | They will soon acquire SEEDINVEST | Mergers and acquisitions cause internal disruption | They don’t participate in investment rounds | They help package the Startup and then distribute the package to their investor base | 4 |

| Wefunder | Platform decides who they invest in | Public Benefit Corporation | 6,700 investors have invested $20M | They charge a single flat fee: 7.5% of funds successfully raised – i.e., no equity is given hence no dilution occurs | Investment size ranged from $50K – $250K | US-Centric | 3 |

| Republic | $1.5Bn raised across their ecosystems which includes the Seedrs.com Platform that covers UK and EU Startups | 600 Startups funded | Flat fee of 7% of funds raised + 2% of the equity | Investment rounds ranged from $100K – $1M | They don’t participate in investment rounds | They help package the Startup and then distribute the package to their investor base | 5 |

| Netcapital | New and relatively small means they can get things done quicker than incumbents | Using new legislation to access retail investors [In May 2016, Title III of the JOBS Act became effective, and startups are now able to raise money from the general public. Anyone can invest subject to the limits set forth in the Title III rules] | Very thin track record to rely on | They don’t participate in investment rounds | They help package the Startup and then distribute the package to their investor base | 7 |

| AngelList | Global | 18,493 Startups raised capital through AngelList in 2022 | $15Bn in committed capital | 40% of all US Unicorns have had GP invest in them through AngelList | Average Syndicate Round size is $200K and the range is from $100K – $1M | They are a HYBRID between an Equity Crowdfunding Platform and an Investor Database Platform | You need to approach Angel Syndicates to make an investment in your Startup | Besides giving up equity, you pay between $0 – $130 a month – billed ANNUALLY – to access the platform and tools | 6 |

Startup Investor Platform – 2022 Equity Crowdfunding Success Rate Comparison

Startup Resources

My Products

I’ve put together a series of free and paid products and services that will help every Founder or Founding Team accelerate their Fundraising knowledge acquisition and hence close more investors.

Read MoreStartup Investor Platform – 2022 Database Value Comparison

| Platform | Pros | Cons | Rank |

| Investorhunt | InvestorHunt provides a comprehensive database of investors, helping startups find relevant potential backers efficiently The bare minimum subscription needed is their PRO offering at $97/mth |

The platform’s focus is on investor data rather than providing an integrated fundraising solution They don’t offer any additional help in preparing, running and closing the fundraising campaign |

4 |

| OpenVC | OpenVC facilitates connections with venture capitalists and institutional investors. Making it ideal for startups seeking large-scale funding They mention that you can “get $250K in software (app) discounts”. I could not find the T&Cs that govern that offer According to their blog, their basic membership level is $149 a year |

The platform is not suitable for early-stage startups due to its focus on institutional investors | 2 |

| Foundersuite | Foundersuite offers a suite of tools and resources to assist startups throughout the fundraising journey. From investor management to pitch preparation | The platform’s pricing is on the higher side for early-stage startups on a tight budget Their Gold Plan subscription is the only plan that makes sense for most SEED fundraising campaigns and is priced at $745/yr charged annually |

1 |

| Crunchbase | Crunchbase is a vast database of companies, investors, and funding information, offering valuable market insights to startups | It is primarily a data (research) platform and does not provide many tools and resources to assist startups throughout their fundraising journey Their Pro Plan subscription is priced at $49/mth charged annually. It does not really have enough flexibility to run a decent-sized campaign. It seems you can only ad 10 contacts a month into (their) CRM? Hence most Startups would need to upsize to Crunchbase’s Enterprise Plan for which there are no pricing details listed |

3 |

| Pitchbook | Pitchbook provides comprehensive financial data and analytics. Enabling startups to make data-driven decisions during the fundraising process Next to PREQUIN it is THE most comprehensive and up-to-date database of startup/venture deal/transaction history on the market today |

Like Crunchbase, Pitchbook is not a direct fundraising platform but rather an information service Pitchbook never publish prices. I know from experience that one seat cost between $12K and $15K a year, charged yearly |

5 |

FAQs

- If I subscribe to an Investor Database, are the investors listed in the Database open to being approached directly by Startups (cold outreach), and are their particulars up to date and complete?

In my experience, this is THE question. Pitchbook and Crunchbase invest more $$ into research and hence they have quite up-to-date information. Others less so. However, these are what they say, Databases. There isn’t a relationship between the investors listed in the Database and the Database sponsor/owner. And contrary to what some angel investors and venture investors might state on their websites or LinkedIn, no investor welcomes cold outreach that is not at least well-researched and professional. - Are these investor platforms suitable for all types of startups?

While the investor platforms mentioned in this blog cater to a wide range of industries and sectors, not all platforms are equally suitable for every type of startup. Some platforms specialize in specific industries, while others may focus on early-stage or growth-stage startups. It’s essential to carefully review each platform’s offerings and target audience to find the one that aligns best with your startup’s niche, goals, and stage of development. - Is there a Strategy to use that will improve my chances of running a successful Equity Crowdfunding Campaign?

YES. A Startup should try to raise between 5% and 25% of the target amount from Friends and Family and Angel investors. The investors and decision makers of Equity Crowdfunding Platforms see that as a strong signal, the same that a VC investor would. - How can I ensure the credibility of the investor platforms listed in this blog?

Ensuring the credibility of an investor platform is vital to protect your startup from potential risks and scams. To verify the legitimacy of a platform, conduct thorough research. That includes reading reviews and testimonials from other startup founders who have used the platform. Also, check if the platform complies with relevant regulations. Additionally, look into the platform’s history, track record, and any accolades or certifications it may have received. - What factors should I prioritize when choosing an investor platform for my startup?

The decision to choose an investor platform should be based on a combination of factors that align with your startup’s specific needs and objectives. Some crucial considerations include:

Target Audience: Does the platform attract the type of investors you’re seeking for your startup? Are they interested in your industry or niche?

Pricing and Fees: Carefully assess the platform’s pricing structure, including upfront charges and any additional fees tied to fundraising success.

Support and Services: Evaluate the level of support the platform offers during and after the fundraising process. Look for platforms that provide assistance with due diligence, marketing, and post-investment support.

User Experience: Is the platform user-friendly and intuitive? A smooth user experience can significantly impact your fundraising journey.

Credibility and Reputation: Research the platform’s credibility, track record, and reviews to ensure you’re partnering with a reputable and trustworthy entity.

By considering these factors, you will make an informed decision that maximizes your chances of success and helps you secure the right funding for your startup.

Conclusion

Startup Fundraising is a numbers game.

The best “ODDS” are received by those Startups that gain entry into one of the top 10 global Startup Accelerators – Y Combinator or YC, Sequoia (Arc or Surge programme), 500 Global, Techstars, Plug and Play, SOSV, MassChallenge, Founder Institute, NFX, Launch.

Around 4% of applicants make it into these accelerators. However, once in, many Startups raise capital before the end of programme “Demo Day”. Most secure their capital needs based on the Accelerator Sponsor (i.e. the VC behind the accelerator) investing the first cheque, and arranging other VCs to invest alongside them.

For everyone else, between 0.5% and 1% of all startups that want to raise external capital actually succeed.

You must be aware of your Startup stage – i.e., Ideation stage vs MVP vs Product-Market Fit and early revenue vs established and growing MRR and ARR.

That should be your jumping-off point.

Therefore, when deciding if you should try Crowdfunding or use an Investor Database, you need to understand the odds of success. For example, take the Crowdfunding route and still use the Database strategy if Crowdfunding does not work. Or vice-versa or potentially use both simultaneously.

About the Author

James Spurway is an Angel Investor, Mentor, Advisor, Speaker, former Commercial Pilot, and Author who specializes in raising debt and equity capital. He strives to model diversity, equity, and inclusion in the founders he agrees to invest and work with.

He paused his angel investing activity in January 2023 to focus on raising his first US$ 50M venture capital fund, which will invest in startups that can accelerate the achievement of net zero emissions.

James spent the past 33 years living in Hong Kong, Vietnam, Germany, Switzerland, Monaco, the USA, Thailand, the Philippines, Singapore, and Australia, his country of birth.

In that time, he started 10 businesses, exited from seven, shut down two, and kept one. He invested in a total of 50 startups since 2001 and had six successful exits.