Unlike furloughs and layoffs, where you intend to call back the employees when business circumstances change, a reduction in force or RIF is a permanent removal of posts. Some layoffs and furloughs turn into a RIF if the business doesn’t pick up for an organization again.

Why Did Reduction In Force Events Happen?

Whilst reduction in force events have occurred across the globe, 89% of employee job losses occurred in the USA.

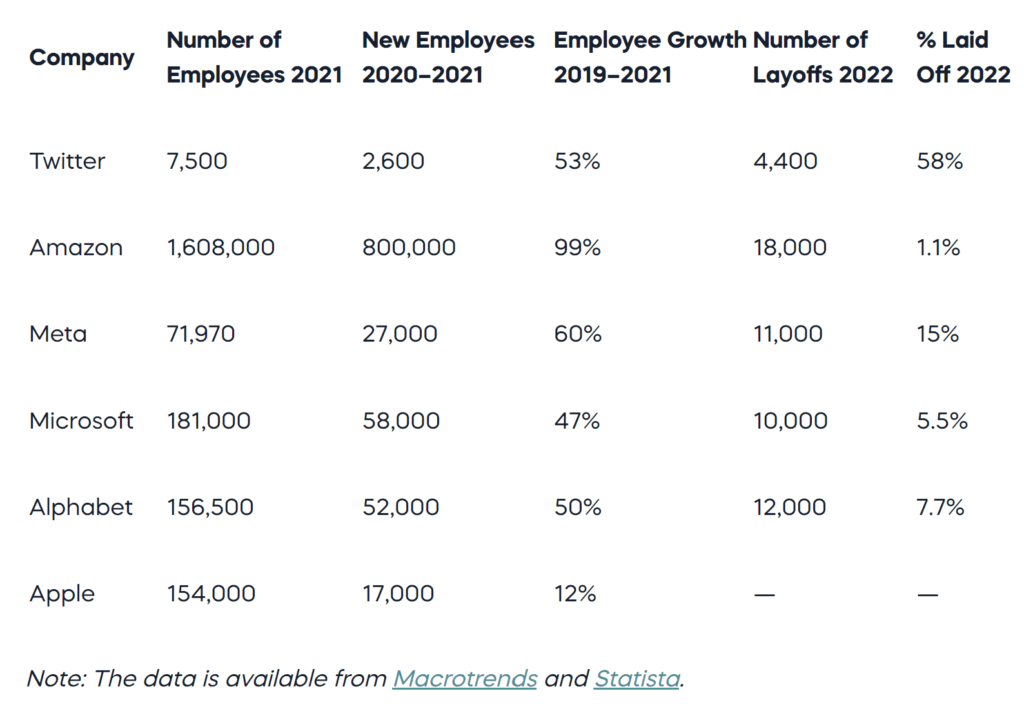

With reference to the following table, it can be seen that the largest tech companies started a hiring spree in 2020 after COVID hit, partly because other companies laid off good staff and hence they were available, and partly because these tech companies experienced a massive increase in user demand as everyone started working from home.

The media has focused on the size of the RIFs. From the table below it is clear that Twitter is the only major US Tech company that has laid off more employees in the period 2022/3 to date than they added in the period 2020/1. Every other major tech company has seen a net employment increase, in Amazon’s case by as much as 98.9%!

The source article can be read in full here.

Reduction Of Force

If you landed on this blog after typing in “Reduction Of Force”, you can now read all about it. Even though most writers use the term “Reduction In Force”.

Reduction In Force Checklist

The following checklist could be used as a guideline by a Startup with a small or no HR function if they find that they need to make a RIF.

Click this link and you’ll be redirected to my Google Drive folder where you can download the word file.

About The Author:

James Spurway is an Angel Investor, Mentor, Advisor, Speaker, former Commercial Pilot, and Author who specialises in raising debt and equity capital. He strives to model diversity, equity, and inclusion in the founders he agrees to invest and work with. He has paused his angel investing activity to focus on raising his first US$ 50M venture capital fund, which will invest in startups that can accelerate the achievement of net zero emissions. James spent the past 33 years living in Hong Kong, Vietnam, Germany, Switzerland, Monaco, the USA, Thailand, the Philippines, Singapore, and Australia, his country of birth. In that time, he started 10 businesses, exited from seven, shut down two, and kept one. He has invested in a total of 50 startups since 2001 and had six successful exits.