As Startup Founders or people working in the Startup Ecosystem, you probably heard the terms Business Model vs Revenue Model used in conversations. And you probably had the impression that there are one and the same.

I can understand that.

To ensure I got the “facts straight” on this topic, I naturally referred to authority figures and companies from within the Startup/Venture Capital space.

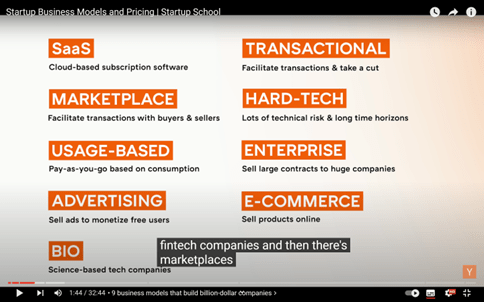

Y Combinator (YC) wrote this post on Business Models.

Founder’s Institute (FI) wrote this post on Revenue Models.

Business Model vs Revenue Model

Let’s break down the YC video first.

The 9 Business Models

YC Group Partner Aaron Epstein makes the point that nearly all Startups that went on to become Unicorns, used one of the nine (9) business models above.

YC1 – SaaS (Software as a Service)

Cloud-based subscription software

Examples: Adobe, Zoom, Slack

PRIMARY METRICS:

Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR)

Growth Rate: Measured weekly or monthly

Net Revenue Retention: % of recurring revenue retained from a prior period

CAC: Costs to acquire a new customer

TAKEAWAYS:

All the benefits of recurring revenue

Can have non-recurring revenue, but don’t include in ARR/MRR

Usually sold to businesses, ideally on annual contracts

Growth can be driven by direct sales, self-serve acquisition channels, or both

YC2 – Transactional

Facilitate transactions and take a cut

Examples: Stripe, Coinbase, Wise

PRIMARY METRICS:

Gross Transaction Value (GTV): Total payment volume transacted

Net Revenue: Fees charged for transactions (often a %)

User Retention: % of month 1 customers that make a purchase in month 2, etc

CAC

TAKEAWAYS:

Usually fintech and payments businesses

One-time transactions rather than recurring

Often high volume with a low fee (1-3% is common)

Best transactional businesses have extremely consistent revenue from high repeat usage

YC3 – Marketplaces

Facilitate transactions between buyers and sellers

Examples: Airbnb, Doordash, Etsy

PRIMARY METRICS:

Gross Merchandise Value (GMV): Total sales volume transacted

Net Revenue: Fees charged for transactions (often a % take rate)

Growth Rate

User Retention: % of month 1 customers that make a purchase in month 2, etc

TAKEAWAYS:

Hard to get off the ground, chicken & egg problem

Need to scale supply and demand in sync

Network effects at scale drive exponential growth

When they work, often become dominant winner-take-all winners

YC4 – Subscription

Product or service sold on a recurring basis, usually to consumers

Examples: Amazon Prime, Classpass, Netflix

PRIMARY METRICS:

Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR)

Growth Rate: Measured weekly or monthly

User Retention: % of month 1 customers that make a purchase in month 2, etc

CAC

TAKEAWAYS:

Recurring revenue is the most valuable revenue

Usually sold to consumers, often paying monthly

Usually lower price points, from a higher volume of customers

Growth driven by scalable, self-serve acquisition channels

Halfway mark of the Business Model vs Revenue Model YC Video breakdown…keep going!

YC5 – Enterprise

Sell large fixed-term contracts to big companies (5k+ employees)

Examples: Workday, Salesforce, SAP

PRIMARY METRICS:

Bookings: Total signed contract value (recurring + non-recurring)

Revenue: Recognized when delivering on the contract

Annual Contract Value (ACV): Total contract value / # of years

Pipeline: Top of funnel → Demo → Close

TAKEAWAYS:

Very few customers, much larger deals ($100k+/year)

Growth is driven by direct sales

Often begin with paid pilots or LOIs

Usually long sales cycles, with many gatekeepers

The buyer is not always the end user

Lumpy growth: measuring m/m growth rate doesn’t make as much sense

YC6 – Usage Based

Pay-as-you-go based on consumption in a given period

Examples: AWS, Twilio, Algolia

PRIMARY METRICS:

Monthly Revenue (not recurring!)

Growth Rate

Revenue Retention: % of revenue from last month’s customers in this month

Gross Margin: Revenue – Cost of Goods Sold (COGS)

TAKEAWAYS:

Don’t confuse usage-based revenue with recurring revenue

Charge per API request, # of records, data usage, etc

Grow as your customers grow

Product and pricing scale to support tiny startups to large enterprises

YC7 – E-commerce

Sell products online

Examples: Amazon, Warby Parker, The Home Depot

PRIMARY METRICS:

Monthly Revenue: Total sales

Growth Rate: Measured weekly or monthly

Gross Margin/Unit Economics: Revenue – Cost of Goods Sold (COGS)

CAC

TAKEAWAYS:

Includes D2C brands and Shopify stores

Not marketplaces, so keep 100% of each sale

Higher COGS = lower margins

Products often commoditized

Need to be excellent at user acquisition and operations/unit economics

YC8 – Advertising

Sell ads to monetize free users

Examples: Facebook, Twitter, Reddit

PRIMARY METRICS:

Daily Active Users (DAU): Unique users active in a 24-hour period

Monthly Active Users (MAU): Unique users active in a 28-day period

User Retention: % of active users on D1/7/30/etc

CPM (Cost Per Thousand) or CPC (Cost Per Click)

TAKEAWAYS:

Typically consumer social products with huge scale

The customer is the advertiser, not the end user

Users are the product being sold

Need billions of impressions each month

Registered Users is a vanity metric

YC9 – Hardtech/Bio/Moonshots

Hard businesses with lots of technical risks and long time horizons

Examples: Boom, Pfizer, Cruise

PRIMARY METRICS:

Milestones: Progress towards the long-term vision

Signed contracts

Letters of Intent (LOIs): Non-binding contracts indicating interest to purchase

TAKEAWAYS:

Often take years to get to a live product because of technical and/or regulatory risk

Impressive technical milestones or experimental data can de-risk the tech

Revenue is often years away, so signed LOIs are usually the best way to show customer interest

I think most of us would be comfortable with these nine categories and have heard of or used one or more for our own businesses.

I’m sorry about this Business Model vs Revenue Model post being a bit lengthy…I can assure you it’s worth it!

Business Model vs Revenue Model

Now let’s break down the FI post.

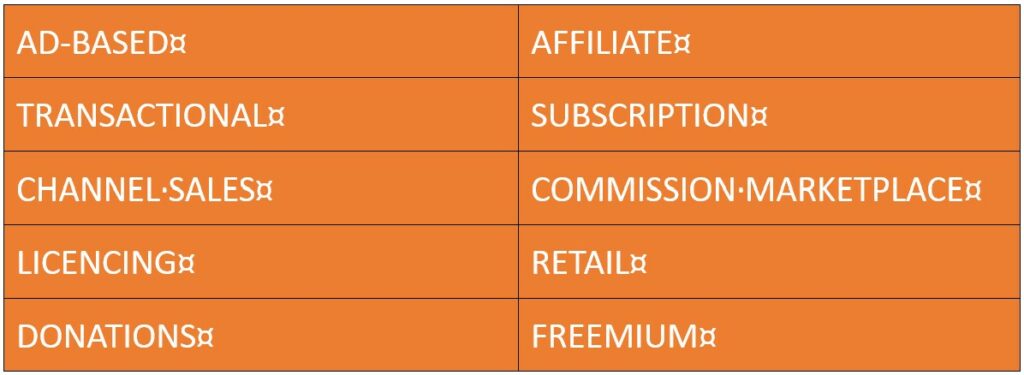

The 10 Revenue Models

The post identifies ten (10) types of Revenue Model

FI1 – Ad-Based Revenue Model

Ad-based revenue models entail creating ads for a specific website, service, app, or other product and placing them on strategic, high-traffic channels. If you have a platform that generates a lot of traffic, you can profit by selling advertising space. We are all familiar with digital promotions as this is a preferred marketing strategy of giants like Google and Facebook.

There are four main categories of advertising strategies: display, video, mobile, and native. Data plays a critical role in measuring ads performance, and you should be able to provide advertisers with precise metrics like CTR (clickthrough rate), CPC (cost-per-click), CPM (cost-per-impression), and many others.

Advantages:

Making money from ads is one of the simplest and easiest ways to implement revenue models, which is why so many companies utilize ads as a source of revenue.

Disadvantages:

In order to generate sufficient revenue to withhold a business, you will need to attract millions of users. In addition, most people find ads annoying, which can lead to low clickthrough rates and, therefore, lower revenue.

FI2 – Affiliate Revenue Model

Another popular web-based strategy is the affiliate revenue model, which works by promoting links to relevant products and collecting a commission on the sales of those products. It can work in conjunction with ads or separately. This method is basically a contract between a supplier of a product/service and a promoter where the promoter redirects buyers to the sellers, who then finalize the transaction. Popular companies that offer affiliate marketing schemes for partners are Amazon and Shopify.

Advantages:

One of the most obvious benefits of employing an affiliate revenue model is that it generally makes more money than ad-based revenue models.

Disadvantages:

If you use an affiliate revenue model for your startup, remember that the amount of money you make is limited to the size of your industry, the types of products you sell, and your audience.

FI3 – Transactional Revenue Model (direct and web)

Countless companies, both tech-oriented and otherwise, strive to rely on the transactional revenue model for a good reason. This is one of the most upright ways of generating revenue, as it simply implies a company providing a service or product and customers who pay for it.

Advantages:

Consumers are more attracted to this experience because of its clarity and the wider set of options.

Disadvantages:

Because of the directness of the transactional revenue model, many companies employ it themselves, which means more competition and price deterioration, and therefore, less money for everyone who uses this model.

The transactional revenue model can be broadly split into two categories – web sales and direct sales.

• Web sales have grown radically in the last few years and are suitable for a huge variety of offerings, including software, hardware, and even subscription services. At the same time, relationship sales are incompatible with the web sales model, so if your company is related to consulting or big-ticket items (high-value items such as houses, appliances, and cars), you should consider employing a model that goes together with your offering better.

• Direct sales can be inside sales, in which someone calls in to place an order (or sales agents call prospects), and outside sales, which is a face-to-face sales transaction.

Direct sales models are efficient with relationship sales cycles, enterprise sales cycles, or complex sales cycles that entail multiple buyers and influencers. However, these kinds of operations often require hiring a sales team of some sort, which means that it isn’t optimal for small ticket price items. If your offering is priced below the $1,000-$2,000 range, you’ll have trouble building a scalable company by selling directly.

FI4 – Subscription Revenue Model

In the subscription revenue model, you offer your customers a product or service that they can pay for over a longer period of time, usually month to month or year to year. Subscription as a Service (SaaS) providers usually give users a free trial before they start charging them monthly or yearly.

According to recent research, companies like Netflix, Spotify, and millions of others adopting the subscription-based revenue model, constitute an industry that has grown over five times in the last seven years.

Advantages:

If your company is far enough along in its development, this model can generate recurring revenue and can even benefit from customers who are simply too lazy to cancel their subscription to your company (which is the dirty little secret of a subscription-based model).

Disadvantages:

Because this model depends so much on having a large consumer base, it is critical to maintain a higher subscription than unsubscription rate.

FI5 – Channel Sales (or Indirect Sales)

The channel sales model consists of agents selling your product for you and either you or the reseller delivering the product. The affiliate revenue model is a good companion to this one, especially if your offering is a virtual product.

A classic example of channel sales revenue model is wholesale merchants supplying regional distributors.

Advantages:

The channel sales model is ideal for companies with a product that’s an incremental sale for their channel and can produce an accumulative profit.

Disadvantages:

Don’t employ this model if your product requires you to evangelize your marketplace or if your product competes with your partner’s, as they will push theirs and not yours.

Yay! You’ve made it to the halfway mark on the Business Model vs Revenue Model section on revenue models from Founder’s Institute!

FI6 – Commission Marketplace

The commission marketplace is most often an e-commerce platform where intermediaries sell services or products and charge a commission. This is a perfect revenue match for rentals, physical products, or one-time services.

Among the most successful startups that rely on this cash flow plan are Uber and Airbnb.

Advantages:

The commission-based revenue model is lucrative because of its scalability, flexibility, and monetization potential for all parties involved.

Disadvantages:

This type of mediatory service requires plenty of software development and administration workforce for handling orders, payments, shipping, and other processes that might be relevant.

FI7 – Licensing

This revenue model is widely embraced by data and technology providers. As the name suggests, the licensing income strategy is about managing the rights to use an offering. After signing a legal agreement, the copyright owner receives payments from people or organizations that want to use their products or services.

The licensing deal can be temporary or permanent; it can grant access to an unlimited number of clients, or it can be exclusive.

Advantages:

This revenue model advocates for intellectual property protection. When fulfilled properly, licensing can deliver a steady income while simultaneously promoting a concept or a trademark.

Disadvantages:

The downfall of this type of monetization might be hidden in the small print of the contract between the licensor and the licensee. If too many extra clauses on how to use the product are apparent, it becomes easy to breach them.

FI8 – Retail

The retail revenue model demands setting up a traditional store in which you offer physical goods to your customers. Keep in mind that this brick-and-mortar style of sales requires shelf space (that you’ll have to pay for) at existing stores, and is designed for companies that have logistics and storage capabilities.

Advantages:

Retail sales are a great way to offer deals and complimentary products to an existing customer base and help boost brand awareness.

Disadvantages:

The retail sales route is not ideal for early-stage companies or companies that offer digital products like software or apps.

FI9 – Donations

This is probably the newest revenue model on the list. It became known through the emergence of crowdfunding platforms like Kickstarter and Patreon where users vote for a product or a service and support it financially.

People who pay for the development of an MVP may even become investors and can later benefit from dividends when the project they have endorsed grows.

Advantages:

This revenue model can generate fast returns and win you high visibility. It is also a smart way to get feedback, test a business idea, and examine your audience closer.

Disadvantages:

You will need a large and loyal community backing you up in order to drive solid revenue. Users who are willing to pay for an idea or a piece of content will likely expect you to interact with them, so save some time for that as well.

FI10 – Freemium Revenue Model

The freemium model is one in which a company’s basic services are free, yet users must pay for additional premium features, extensions, functions, etc. One of the biggest companies to use this model is LinkedIn, the most popular business social media platform. Another example is the email marketing platform MailChimp – on the free plan, you can still send out emails, but only utilizing basic features and addressing a limited number of contacts.

Advantages:

The freemium model offers something free to users, which is a great way to give them a taste of your product or service while simultaneously enticing them to pay for something later on.

Disadvantages:

This model requires a considerable investment of time and money to reach out to your audience, and even more effort to convert free users into paying customers.

Conclusion

1. There are a few categories of Business Models that also seem to describe a comparable Revenue Model

2. Mostly they are different

3. In the earliest stages of planning our Startup, we often use a tool such as Business Model Canvas or Lean Canvas.

About the Author

James Spurway is an Angel Investor, Mentor, Advisor, Speaker, former Commercial Pilot, and Author who specialises in raising debt and equity capital. He strives to model diversity, equity, and inclusion in the founders he agrees to invest and work with.

He has paused his angel investing activity to focus on raising his first US$ 50M venture capital fund, which will invest in startups that can accelerate the achievement of net zero emissions.

James spent the past 33 years living in Hong Kong, Vietnam, Germany, Switzerland, Monaco, the USA, Thailand, the Philippines, Singapore, and Australia, his country of birth.

In that time, he started 10 businesses, exited from seven, shut down two, and kept one.

He has invested in a total of 50 startups since 1993. In the period from 2003 until 2020, he had two successful exits from Unicorn startups. His average ROI sits at around 5X to date.