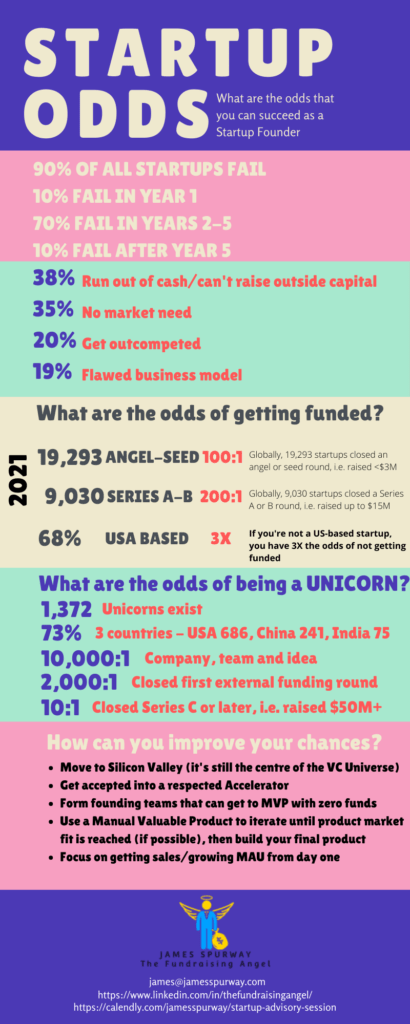

In Case You Want To Know How To Be A Startup Unicorn, The Odds Of Success Are About 10,000:1

When considering how to be a Startup Unicorn, your chances will improve if your Startup is in one of these categories:

➽ Gaming – virtual service or good

➽ E-Commerce / Marketplace – pay for a real-world good or service

➽ Advertising / Consumer Audience Building

➽ SaaS – users pay for cloud-based software via a subscription model

➽ Enterprise – companies pay for a large scale (company-wide) software (in modules) via a subscription model

Who Teaches You How To Become A Unicorn

Reaching unicorn status — a billion-dollar valuation as a private company — requires more than a disruptive product and runaway demand. It takes a commitment to growth and a solid approach. You need to know how to scale people, processes, and systems.

While unicorn status used to be quite rare (hence the name), more and more unicorns appear every year. According to Wired, while there were around four unicorns created per year since the term was coined in 2013, more than 250 unicorns were minted in 2021 alone.

This trend is often attributed to increased access to capital from angel and VC investors. Not to be overlooked, however, is the fact that startup teams today come with more experience and knowledge about how to scale a company quickly, and that includes their finance and accounting operations.

Traditionally, finance and accounting have been viewed as a support operation — expected to scramble to keep up with the pace, or at least avoid adding too much friction to a company’s growth. But modern finance and accounting teams are rewriting their role.

They provide real-time financial data for decision-making and build analytic models to evaluate opportunities. In short, they help drive businesses forward instead of just reporting on their past.

About the author:

James Spurway is an Angel Investor, Mentor, Advisor, Speaker, former Commercial Pilot, and Author who specialises in raising debt and equity capital. He strives to model diversity, equity, and inclusion in the founders he agrees to invest and work with. He has paused his angel investing activity to focus on raising his first US$ 50M venture capital fund, which will invest in startups that can accelerate the achievement of net zero emissions. James spent the past 33 years living in Hong Kong, Vietnam, Germany, Switzerland, Monaco, the USA, Thailand, the Philippines, Singapore, and Australia, his country of birth. In that time, he started 10 businesses, exited from seven, shut down two, and kept one. He has invested in a total of 50 startups since 2001 and had six successful exits.