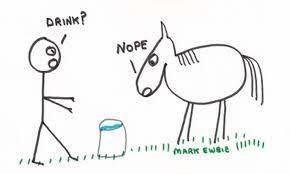

Need capital for your startup? Right now the fundraising environment is fickle and will remain so for the rest of 2023. So I’m advising my mentees and portfolio companies to be like a camel, not a horse. take capital if it’s available and store it until they need it. Don’t wait until you need it to start looking. It could all have dried up!

Camels drink when water is available, and horses (try to) drink when they are thirsty.

In a recent post on Linkedin, I explained that capital (water) is getting scarcer by the day, especially for Startups raising later-stage rounds (eg – Series C onward). However, Founders who are currently raising a SEED round should definitely take note.

Every Startup Will Need Capital At Some Point

I’ve learned much about investing and fundraising in the past 30 years. However, I still invest a chunk of time each week consuming content from other (more) successful entrepreneurs and angel investors like Jason Calacanis.

He hosts the All-in Podcast, and This Week In Startups Podcast, both top-rated on streaming platforms.

He also runs the LAUNCH startup accelerator, and several thematic angel syndicates, oh and he finds time to teach prospective investors how to become successful angel investors, and teach founders how to get the right start.

In short, he’s the real deal.

If you find his credentials as impressive as I do, and you want to raise capital from angel investors, I implore you to invest time to hear what he has to say in this YouTube interview with Scott Orn, Partner at Kruze Consulting.

Need Capital For Your Startup? Take Note.

His #1 Tip in the above interview is – “When you need capital for your startup, always take a little extra money. Don’t be afraid of diluting a little bit more than you planned because that money could be the key to getting you to the next round of funding”.

Managing your cash & building a model

- You and your internal team:

You need to know exactly where you are every month, including a basic income statement. Use this information to calculate your runway. Critical to always know exactly how many months of cash you have left.

Jason looks at 3 things in his companies:

The burn based on the month and the cash. For example, last month we burned $50k and we have $500k in the bank. $500k/$50k = 10 months of runway.

What’s the last 3 months’ average. For example, broke even one month, lost 100k the second month, and lost 50k the third month. That would be $150k/3 = $50k. Now divide $50k into $500k and we get the same number (i.e. 10 months runway).

What they made and lost during each of the last 3 quarters.

- Your board and your investors:

- When you’re going into a board meeting, always take a screenshot of the cash balance in your account. CFOs have been fired for not knowing the number in the bank account.

- Don’t surprise your board. The quickest way to be removed from your own startup is to surprise the board with an unhappy cash burn surprise.

- Founders should send monthly updates to investors within the first 10 days of the month. The first bullet point should be cash in the bank, then burn rate, then how many months of cash are available.

- For internal use, you do not need to start from scratch when building a financial model. There are templates you can use. This will save you a lot of time. This is usually all you need to raise a seed round.

- When building financial models for investors and board members, you may want to hire a finance professional to help you build it out. Investors look at things like revenue scalability, customer acquisition cost, LTV as a multiple of CAC, etc. This level of complexity is usually needed at series A fundraising and beyond.

Communicating strategy via financial models

- A good model is a proxy for your business strategy. You’re telling the story of your startup and its potential.

- Don’t negotiate against yourself. Give investors enough guidance but let them come back to you and tell you what the company is worth. You’re going to see, in those numbers, how badly they want to invest.

You don’t need every VC to give you a term sheet. You need 2 or 3 to have a competitive environment and 1 to say alive. You need to get to 75 of them to get 3. – Jason

- There is no shame in having only one investor who is willing to write a check. The companies raising the most money early on are often not the most successful.

Communicating your model to investors

- A summary of the model is something you can send to investors, initially. Tell them what they’re supposed to see and learn from your full model before having them look at the model. Get them excited with your numbers.

- Clearly communicate exactly how much cash you need and the milestones you’re going to hit with their cash. This is critical.

- When you hire people, their salaries are going to be a big part of the discussion. Personnel costs eventually end up being 50-70% of your spend. You need to build a waterfall of your projected expenses. There is timing and logic involved. Investors are looking for your thought process.

About the Author:

James Spurway is an Angel Investor, Mentor, Advisor, Speaker, former Commercial Pilot, and Author who specialises in raising debt and equity capital. He strives to model diversity, equity, and inclusion in the founders he agrees to invest and work with. He has paused his angel investing activity to focus on raising his first US$ 50M venture capital fund, which will invest in startups that can accelerate the achievement of net zero emissions. James spent the past 33 years living in Hong Kong, Vietnam, Germany, Switzerland, Monaco, the USA, Thailand, the Philippines, Singapore, and Australia, his country of birth. In that time, he started 10 businesses, exited from seven, shut down two, and kept one. He has invested in a total of 50 startups since 2001 and had six successful exits.